Getting to Know PayPal Exchange Rate: How to Prevent Losses

Getting to Know PayPal Exchange Rate: How to Prevent Losses

PayPal is one of the most popular online payment services in the world. By using PayPal, we can carry out financial transactions online easily and quickly. However, PayPal's performance depends not only on its technical capabilities, but also on the currency exchange rate applied. In this article, we will discuss more about the PayPal exchange rate, how it works, and tips to prevent losses.

What is PayPal Exchange Rate?

PayPal exchange rate is the currency exchange rate applied by PayPal to carry out financial transactions between two different currencies. For example, if you want to make a transaction from USD (United States Dollars) to IDR (Indonesian Rupiah), then PayPal will use the applicable exchange rate to convert the amount to be paid.

How Does PayPal Exchange Rate Work?

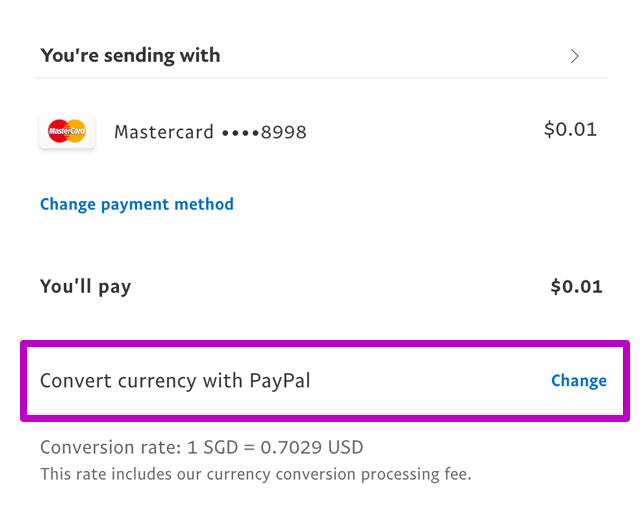

PayPal uses a combination of several methods to determine exchange rates, including:

- Market Exchange Rate : PayPal monitors market exchange rates to determine the applicable exchange rate.

- Transaction Fees : PayPal also charges a transaction fee for each transaction made.

- Margins : PayPal also has a margin that is applied to determine the exchange rate.

Example of PayPal Exchange Rate Calculation

For example, if you want to make a transaction from USD to IDR with an amount of $100, PayPal will use the applicable exchange rate to convert the amount to be paid. The following is an example of calculation:

- Market Exchange Rate: 1 USD = 14,000 IDR

- Transaction Fee: 2.5% of the transaction amount

- Margin: 1.5% of the transaction amount

By using the exchange rate above, the calculation will be:

- Transaction amount: $100

- Transaction fee: $2.50 (2.5% of $100)

- Margin: $1.50 (1.5% of $100)

- Amount due: $104.00

- Exchange Rate: 1 USD = 14,000 IDR

- Amount to be paid in IDR: IDR 1,456,000 (14,000 x $104.00)

Tips to Prevent Losses

When using PayPal, there are several tips you can do to prevent losses due to exchange rates:

- Check the Exchange Rate Before Making a Transaction : Make sure you check the applicable exchange rate before making a transaction.

- Use Bank Transfer Services : If you want to make large transactions, then bank transfer services may be more effective and cheaper.

- Avoid Transactions on Holidays : Exchange rates can fluctuate on holidays, so you should avoid making transactions on these days.

- Use Special Applications : Apps like TransferWise and Revolut can help you make transactions with lower fees and better exchange rates.

Conclusion

PayPal exchange rate can have a big influence on the performance of your financial transactions. By understanding how exchange rates work and using the right tips, you can prevent losses and make more effective transactions. Make sure you check the exchange rate before making a transaction and use a bank transfer service if necessary. Thus, you can enjoy the benefits of using PayPal without worrying about exchange rate losses.

Post a Comment for "Getting to Know PayPal Exchange Rate: How to Prevent Losses"

Post a Comment