Invoicing Fees At PayPal: What You Need To Know

Invoicing Fees at PayPal: What You Need to Know

PayPal is one of the most popular online payment alternatives in the world. With more than 300 million active users, PayPal has become the top choice for many people and businesses for conducting online transactions. One of the most useful features in PayPal is the ability to send invoices to customers. Invoicing allows you to send electronic invoices to your customers and get paid easily. However, as with other services, invoicing on PayPal also has certain fees that you need to be aware of.

What is Invoicing on PayPal?

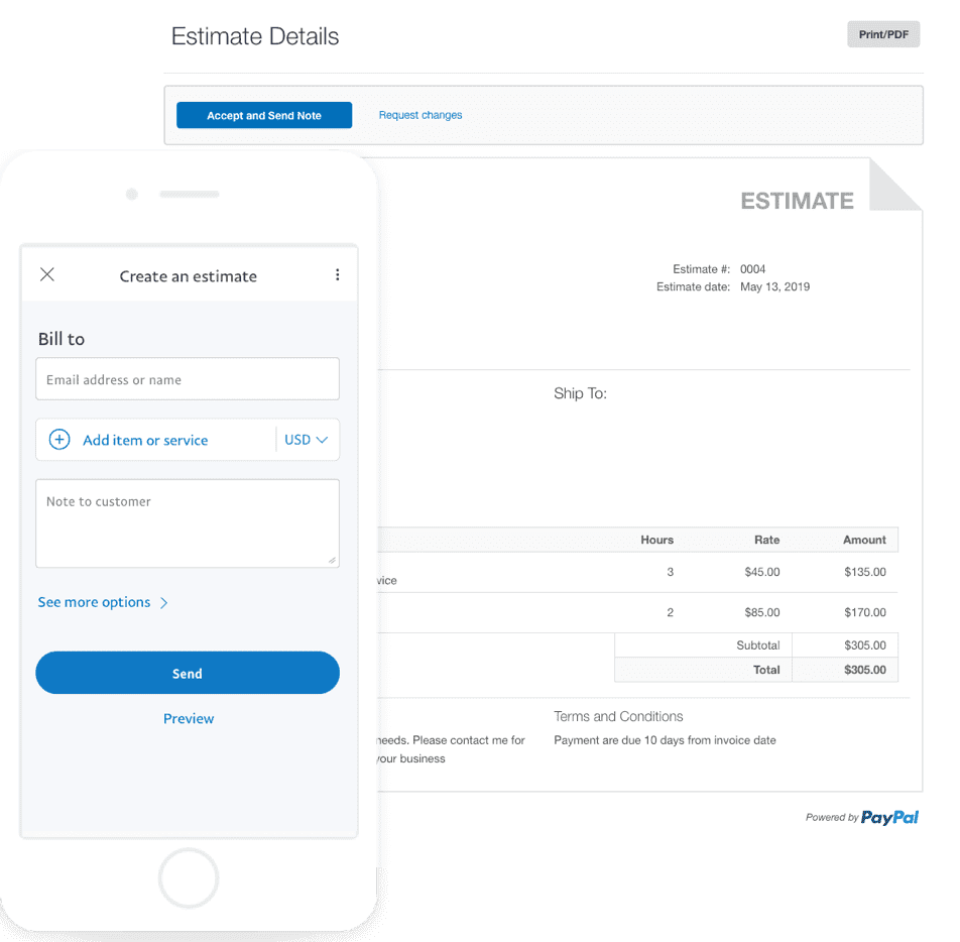

Invoicing in PayPal is a feature that allows you to send electronic invoices to your customers. With invoicing, you can create professional, neat invoices that include all the necessary information, including the amount due, due date, and payment method. Your customers can pay the bill directly via the email they receive, or they can click a link to pay online.

Invoicing Fees on PayPal

Invoicing fees at PayPal vary depending on the country and type of transaction. Here are the invoicing fees at PayPal for several countries:

- Invoicing Fees in the United States : 2.9% + $0.30 per transaction

- Invoicing Fees in the UK : 2.9% + £0.20 per transaction

- Invoicing Fees in Australia : 2.9% + AUD $0.30 per transaction

- Invoicing Fees in Singapore : 2.9% + SGD $0.30 per transaction

The invoicing fees above are fees charged by PayPal for each transaction made via invoicing. This fee will be taken from the amount paid by your customers.

How to Calculate Invoicing Fees on PayPal

To calculate invoicing fees on PayPal, you can use the following formula:

Invoicing Fees = (Amount paid x Invoicing Fees%) + Fixed Fees

Example:

- If you send an invoice of $100 to your customer, and the invoicing fee in the United States is 2.9% + $0.30 per transaction, then the invoicing fee charged is:

Invoicing Fee = (100 x 2.9%) + $0.30 = $2.90 + $0.30 = $3.20

In the example above, the invoicing fee charged is $3.20. This amount will be taken from the $100 paid by your customer, leaving you with $96.80.

Tips for Saving on Invoicing Fees on PayPal

Here are some tips for saving on invoicing fees at PayPal:

- Use PayPal Business : If you have a business, then you can use PayPal Business to save on invoicing costs. PayPal Business allows you to send invoicing at a lower cost.

- Use the Correct Payment Method : Make sure you choose the correct payment method for your invoicing. For example, if you send an invoice for a large amount, then you can choose a payment method that allows you to save costs.

- Avoid Using Credit Cards : Credit cards have higher fees than other payment methods. If possible, then you can ask your customers to pay using another payment method.

- Lunar Devices : Make sure you update your software and applications regularly. Newer software and applications can help you save on invoicing costs.

Conclusion

Invoicing fees at PayPal may vary depending on the country and type of transaction. However, by understanding invoicing costs and using the right tips, you can save costs and increase your income. Make sure you choose the correct payment method, avoid using credit cards, and update your software and applications regularly. This way, you can use invoicing on PayPal more effectively and efficiently.

Post a Comment for "Invoicing Fees At PayPal: What You Need To Know"

Post a Comment