PayPal Earnings Date: What It Takes To Follow PayPal's Financial Releases

PayPal Earnings Date: What It Takes to Follow PayPal's Financial Releases

PayPal is one of the largest online payment companies in the world, offering a variety of financial services including online payments, money transfers, and several other features. For investors and analysts, knowing PayPal's financial release date (earnings date) is very important to understand the company's performance and make the right investment decisions. In this article, we'll discuss PayPal's earnings date, including what to monitor, when PayPal's financial releases typically take place, and how to understand the company's financial statements.

What is PayPal Earnings Date?

PayPal earnings date is the date on which the company releases its quarterly financial reports. This financial report contains various information about company performance, including Revenue, Net Profit, Operating Income and Costs, as well as several other metrics. PayPal's financial reports are usually released every quarter, namely in January, April, July and October.

When Does PayPal Financial Release Typically Take Place?

PayPal usually releases its financial reports after the stock market closes. The exact date of PayPal's financial release may vary depending on the quarter. However, here are some of the PayPal financial release dates that typically take place:

- Quarter I (January-March): Financial releases usually take place in the last week of April

- Second Quarter (April-June): Financial releases usually take place in the last week of July

- Third Quarter (July-September): Financial releases usually take place in the last week of October

- Fourth Quarter (October-December): Financial releases usually take place in the last week of January

What to Monitor in PayPal's Financial Release?

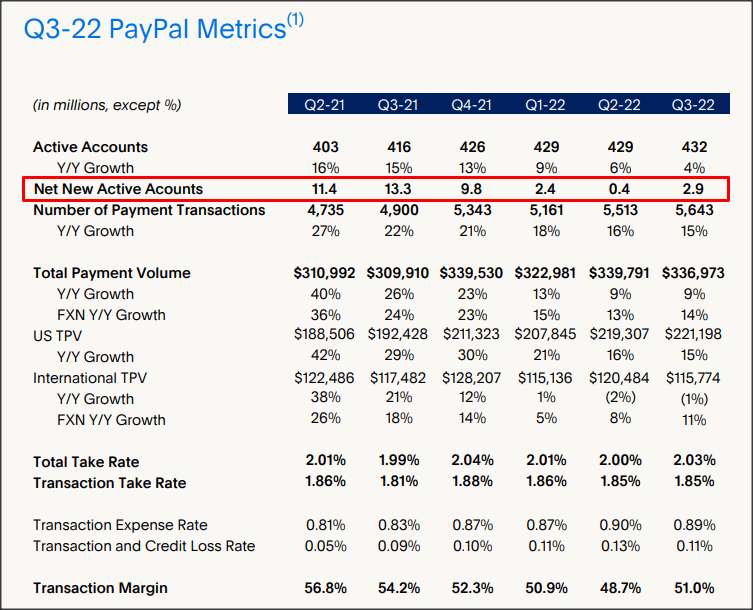

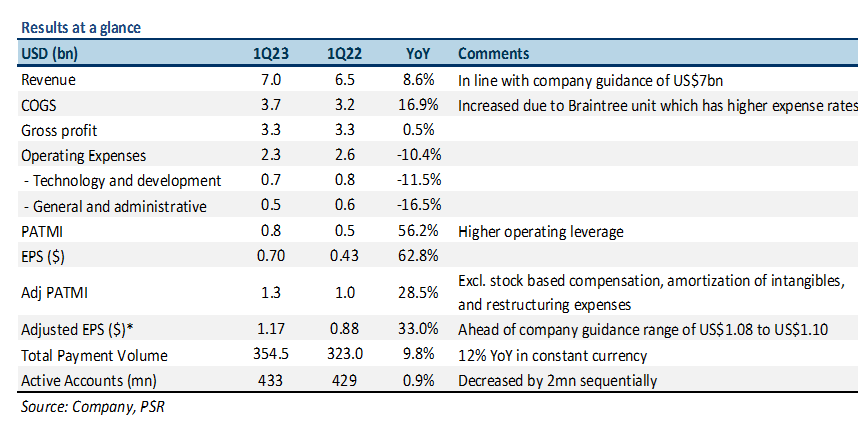

In PayPal's financial release, there are several metrics to monitor to understand the company's performance. Here are some of the most important metrics:

- Income : PayPal's revenue typically comes from two main sources: transaction fees and miscellaneous fees. This company also has several other business lines, such as PayPal Credit and PayPal Working Capital.

- Net profit : PayPal's Net Profit is the profit the company earns after all fees and taxes have been paid.

- Operating Income and Costs : PayPal's Operating Income and Costs describe the company's performance from an operational perspective.

- Increase in Usage : The increase in PayPal usage reflects the growth in the number of active users and transactions carried out on the company's platform.

- Margins : PayPal Margins describes the comparison between a company's Revenue and Net Profit.

How to Understand PayPal's Financial Reports?

To understand PayPal's financial reports, there are several things you need to pay attention to:

- Comparison with Estimates : Comparison of PayPal's financial reports with analyst estimates can provide an idea of the company's actual performance.

- Comparison with Previous Quarter : A comparison of PayPal's financial statements with the previous quarter can provide an idea of the company's actual performance.

- Key Metrics Analysis : Analysis of key metrics such as Revenue, Net Profit, and Usage Increase can provide an insight into the actual performance of the company.

Conclusion

PayPal earnings date is the date on which the company releases its quarterly financial reports. This financial report contains various information about company performance, including Revenue, Net Profit, Operating Income and Costs, as well as several other metrics. By understanding PayPal's financial releases and analyzing key metrics, investors and analysts can make more informed investment decisions. Therefore, it is important to monitor PayPal's financial release dates and perform proper analysis to understand the company's performance.

Post a Comment for "PayPal Earnings Date: What It Takes To Follow PayPal's Financial Releases"

Post a Comment